2021后疫情时代中国保险业创新大会

- 2020年10月14日

- 16:29

- 来源:

- 作者:

2020 is a very difficult year. The sudden outbreak of COVID-19 pandemic worldwide has caused the sharpest economic contraction since the great recession of 1930s, which will lead to a slump in demand for insurance in 2020. It’s anticipated that global insurance premiums will contract by 3.8% in 2020, with life insurance covers down by 4.4% and P&C insurance by 2.9%. While the recession will also be short-lived as the world will gradually recover from the pandemic. Once the world recovers in 2021, global premiums growth should settle at 44% over the next decade, driven by Asia with China at the front.

2020年是异常艰难的一年。新冠疫情在全球范围内的大爆发引起了三十年代大萧条以来最大幅度的经济下滑,保险需求也急剧降低。预计2020年全球总保费将下降3.8%,其中寿险下降4.4%,财险下降2.9%。但是衰退将是短暂的,全球将逐步从疫情中恢复。一旦2021年世界经济复苏,在亚洲的推动下,未来十年全球保费将实现4.4%的增长。中国依然是增长的引擎。

The Insurance Innovation post COVID-19 Conference China 2021 is the largest gathering in China focusing on insurance transformation in the post COVID-19 era and will gather the whole industry players to explore the current and future impacts of COVID-19 and find the ways out for recovery and prosperity.

2021后疫情时代中国保险业创新大会是中国最大规模聚焦后疫情时代保险业发展的高端峰会,将汇聚全行业共同探讨疫情的短期和中长期影响以及寻找后疫情时代中国保险业的复苏与繁荣之路。

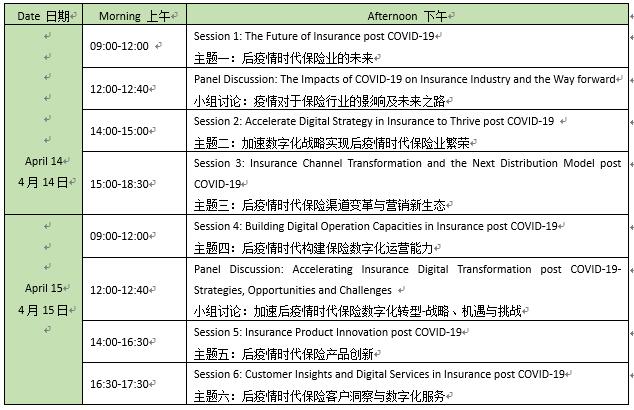

会议时间:4月14-15日|会议地点:中国上海

. Focusing on China insurance transformation and innovation post COVID-19

聚焦后疫情时代中国保险业转型与创新

. The largest conference in China on insurance innovation post COIVD-19

中国最大规模后疫情保险创新峰会

. Sharing Global and local insights

分享国内外观点

. Exploring how COVID-19 drives insurance industry to accelerate digital, innovate products, update distribution, optimize operation and engage with customers to recover and thrive

探讨疫情如何倒逼保险业加速数字化、创新产品、变革营销、优化运营、洞察客户以实现复苏与繁荣

. More than 300+ high level attendees

300+高层参会嘉宾

. What are the impacts of COVID-19 on insurance industry in the short, medium and long term?

疫情对于保险业短期及中长期有哪些影响?

. How can Insurance to recover from the crisis the soonest?

保险业应如何尽快从疫情中恢复?

. How should insurance to innovate and transform to thrive in the future?

保险业应如何创新与转型以实现未来的繁荣?

. How to innovate insurance channels and build next distribution model post COVID-19?

后疫情时代如何创新保险渠道和构建营销新生态?

. How to accelerate digital strategies and transformation in insurance post COVID-19?

后疫情时代如何加速保险数字化战略与数字化转型?

. How to diversify insurance business portfolios post COVID-19 to meet the changing needs?

后疫情时代如何丰富保险产品以适应变化的需求?

. How to build agile and digital operation capabilities in insurance post COVID-19?

后疫情时代险企如何构建灵敏和数字化的运营能力?

. How to develop customer insights and innovate customer experience post COVID-19?

后疫情时代如何洞察客户,创新客户体验?

. How technologies and insurtech will enable insurance transformation post COVID-19?

后疫情时代科技和保险科技将如何赋能保险转型?

. How should insurance agents and brokers to innovate to survive and grow in the new normal?

保险代理与经纪应如何创新以实现新常态下的生存与发展?

. The Future of Insurance post COVID-19

后疫情时代保险业的未来

. The Impacts of COVID-19 on Global Insurance Industry

新冠疫情对全球保险业的影响

. Pursuing COVID-19 Insurance Recoveries in China

推动后疫情时代中国保险业复苏

. Responding to COVID-19 with Digital Solutions and Innovation

数字化方案与创新应对新冠疫情

. The Road of Insurance in the post COVID-19 Era

后疫情时代的保险业之路

. InsurTech to Enable Insurance Recovery and Boom in the New Normal

保险科技助力新常态下保险业复苏与繁荣

. Accelerate Digital Strategy in Insurance to Thrive post COVID-19

加速数字化战略实现后疫情时代保险业繁荣

. Digital Strategy and Blueprint of Insurance post COVID-19

后疫情时代的保险数字化战略与布局

. How should Insurers Embrace and Speed up Digital post COVID-19

后疫情时代保险公司应如何拥抱和加速数字化

. Insurance Channel Digital Transformation post COVID-19

后疫情时代保险渠道数字化转型

. The Next Distribution Model in Insurance post COVID-19

后疫情时代保险营销新生态

. Live Commerce, Fan Economy and Innovation of Insurance Distribution

直播带货、粉丝经济与保险营销创新

. AI and Big Data Make Insurance Distribution Smarter

人工智能与大数据让保险营销更智能

. How COVID-19 Reshapes Insurance Agent

疫情如何重塑保险代理

. Building Digital Operation Capacities in Insurance post COVID-19

后疫情时代构建保险数字化运营能力

. Digital Pricing for post-COVID-19 Transformation

后疫情转型之数字化定价

. Digital and AI Power Underwriting in post COVID-19 Insurance

后疫情时代数字化与人工智能赋能保险承保

. How COVID-19 has Boosted Innovation in Insurance Claims

疫情如何促进保险理赔创新

. New Opportunities for Small and Medium Sized Insurers post COVID-19

后疫情时代中小型险企的新机遇

. Insurance Product Innovation post COVID-19

后疫情时代保险产品创新

. Changes of Customer Needs Emerging in China post COVID-19 Insurance Market

后疫情时代中国保险市场客户需求变化

. The Impacts of COVID-19 on Life Insurance and Annuity Products

疫情对寿险与年金险产品的影响

. COVID-19 Spurs Innovation in Health Insurance & Long Term Medical Insurance

疫情推动健康险产品与长期医疗保险创新

. The Changes of Needs of P&C Insurance Products and Innovation Trends post COVID-19

后疫情下财产险产品需求变化与创新趋势

. Customer Insights and Digital Services in Insurance post COVID-19

后疫情时代保险客户洞察与数字化服务

. How COVID-19 Accelerates the Digitalization of the Insurance Customer Journey

疫情如何加速保险客户旅程数字化

. Telehealth to Expand Access to Essential Health Services

互联网医疗扩大基本医疗服务的可获得性

阅读排行榜

-

1

IHIC2024中国健康保险创新发展大会在上海圆满落幕!

-

2

“数智软件提升新质”——2024中国软件技术大会召开在即

-

3

IHIC健康险创新发展大会即将召开

-

4

精英汇聚,共促保险业繁荣发展,2024第十二届中国保险产业国际峰会圆满收官

-

5

2024年INSight金融洞察力峰会:洞察未来,北京点金!

-

6

倒计时两周!诚邀您参与9月20日上海2024第十二届中国保险产业国际峰会

-

7

第十六届InsurDigital未来保险峰会

-

8

第六届中国保险业数字化与人工智能发展大会2024暨“金保奖”颁奖典礼在沪圆满落幕

-

9

“2024中国寿险&财险科技应用高峰论坛”特邀报告——IFRS17下的保险业务参考模型变革

-

10

IHIC健康险创新发展大会

推荐阅读

-

1

华泰人寿高管变阵!友邦三员大将转会郑少玮拟任总经理即将赴任业内预计华泰个险开启“友邦化”

-

2

金融监管总局开年八大任务:报行合一、新能源车险、利差损一个都不能少

-

3

53岁杨明刚已任中国太平党委委员,有望出任副总经理

-

4

非上市险企去年业绩盘点:保险业务收入现正增长产寿险业绩分化

-

5

春节前夕保险高管频繁变阵

-

6

金融监管总局印发通知要求全力做好防汛救灾保险赔付及预赔工作

-

7

31人死亡!银川烧烤店爆炸事故已排查部分承保情况,预估保险赔付超1400万元

-

8

中国银保监会发布《关于开展人寿保险与长期护理保险责任转换业务试点的通知》

-

9

2024年新能源商业车险保费首次突破千亿元

-

10

连交十年保险却被拒赔?瑞众保险回应:系未及时缴纳保费所致目前已妥善解决